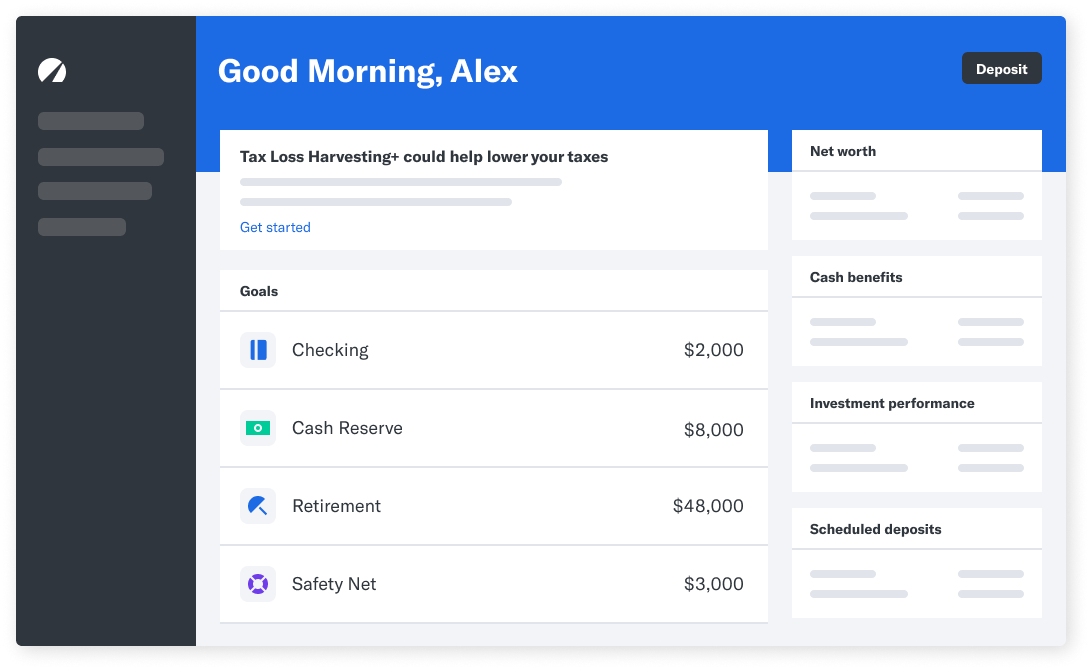

tax loss harvesting betterment

The three steps in the tax-loss harvesting process are. The Digital level does not require a minimum balance and costs a 025 percent annual fee.

Acorns Vs Betterment 2022 In Depth Comparison

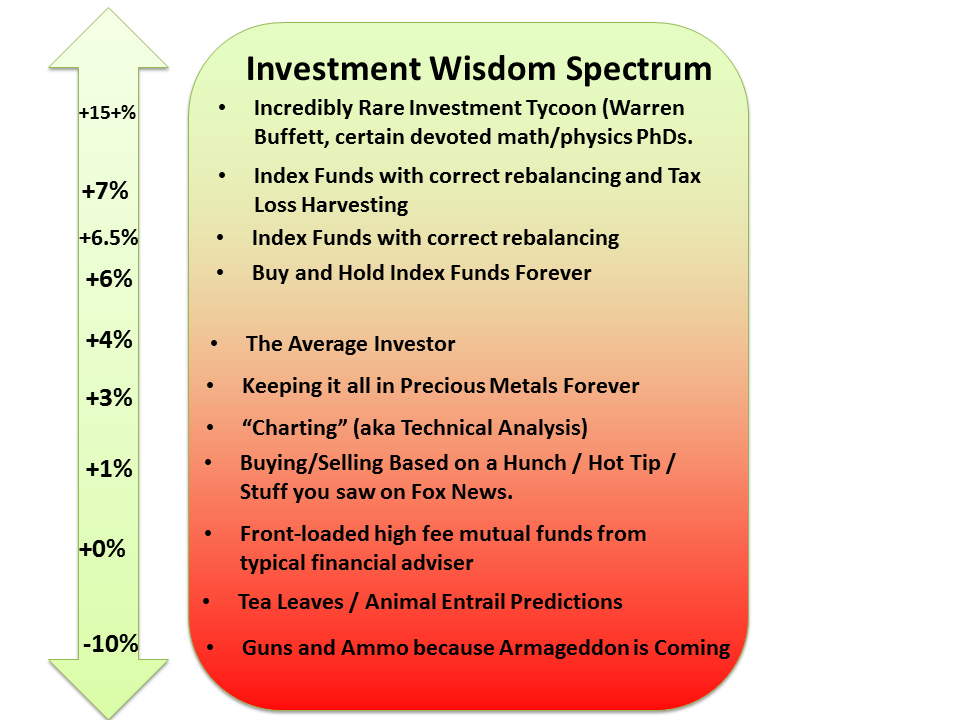

Actually Tax-Loss Harvesting is especially valuable for investors who regularly recognize short-term capital gains.

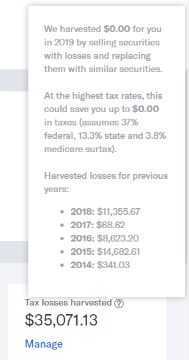

. In its white paper on the Betterment tax loss harvesting program Betterment goes into detail about many issues surrounding ETF. Essentially a tax-efficient Robo-advisor will increase. When investments lose value you can sell them to help offset the taxes that come with income and capital gains.

By realizing or harvesting a loss investors are able to offset taxes on both gains and. Recently many personal finance and investment websites have made the general public aware of a concept known as tax-loss harvesting. Betterment Tax Loss Harvesting Pricing.

2 using the capital loss to offset capital gains on other sales. The automated selling of securities in a portfolio to deliberately incur losses in order to offset any capital gains or taxable income. Updated October 11 2022.

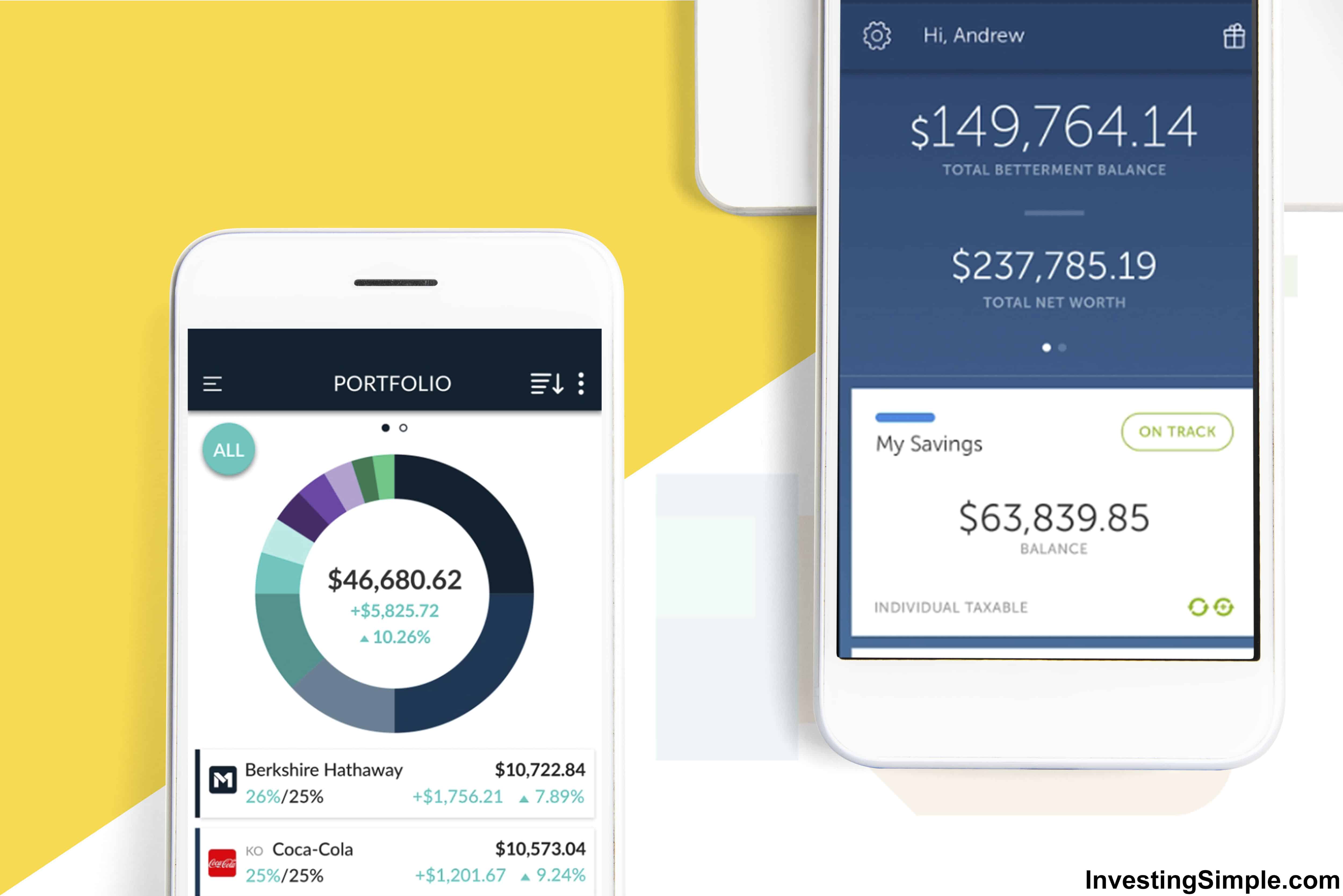

Youre not in the 10 or 15 tax brackets. Tax efficiency is a big factor to consider when choosing a Robo-advisor. The Goals and Benefits of Betterment Tax Loss Harvesting.

Rebalancing helps realign your asset allocation for a balance of. The articles and client support materials available are educational only and not investment or tax advice. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

Tax-loss harvesting is a practice used by investors each year to minimize their tax exposure ultimately maximizing after-tax returns Eric Bronnenkant CFP CPA and head of tax. Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits. Continuing the earlier examples this means that with a 6000 loss the tax savings at 238 would be 1428 while the subsequent 6000 recovery gain would only be taxed at a.

Tax Loss harvesting is the practice of selling a security that has experienced a loss. This is the big one. If you make more than a.

Who Provides What Service. Wealthfront vs Betterment. Robo Tax Loss Harvesting.

The Premium option has a 100000. 1 selling securities that have lost value. We tax loss harvest.

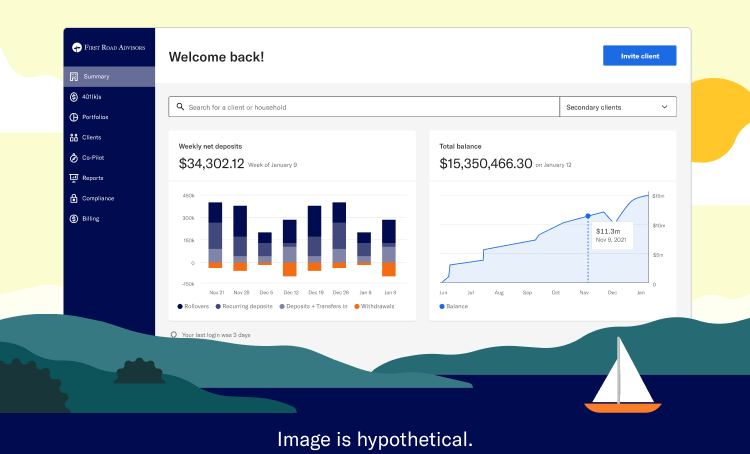

You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax Loss. A robo-advisor such as Betterment would handle all of this for you automatically. Betterment LLC also offers the Betterment Cash.

Harvested losses can be applied to offset both capital gains and up to. One of the best scenarios for tax-loss harvesting is if you can do it in the context of rebalancing your portfolio. Betterment and Wealthfront made harvesting losses easier and more.

We want you to know a few things.

Betterment Review 2021 The Leading Digital Wealth Advisor

Why I Put My Last 100 000 Into Betterment Mr Money Mustache

Tax Smart Investing With Betterment

Owning Vti At Both Vanguard And Betterment Jordan Burnett

Betterment Com Review Easy Investing For Busy People

Betterment Vs Acorns Which Robo Advisor Is Best

Betterment Review Automated Investing And Robo Advisor

Top 5 Tax Loss Harvesting Tips Physician On Fire

Moving A Taxable Account From Betterment To Vanguard A Journey To Fi

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Is Betterment Safe Find Out In This Betterment Review 2022

Betterment Review Invest And Savings Pharmacist Money Blog

Betterment Review How Does This Robo Advisor Compare

M1 Finance Vs Betterment 2022 Best Modern Investing Platform

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Tax Loss Harvesting Is Killing Your Nest Egg The Wealthy Accountant